Have you considered closing down your company but are unsure exactly what to do? Or do you not necessarily want to deregister it, but would you much rather sell it to a third party? This article will dig deep into the topic of share transfer and share allotment – the two primary methods of transferring shares of a company from one party to another. So, what are the differences between the two?

Share Allotment

Let’s say you want to raise capital for your company by introducing additional new members. From a cost point of view, a share allotment is more economically efficient whereas a share transfer requires an extra fee for stamp duty (tax). For example, you have a total share of 10,000 in your company and you want to add 2 more shareholders. Since the total outcome of 10,000 divided by 3 does not equal a whole number, therefore this would not be a viable option. Under this circumstance, it is recommended the sole director add an extra 20,000 shares to the company and distribute to the 2 additional members evenly. Ultimately, there will be a total of 3 shareholders with 10,000 shares each.

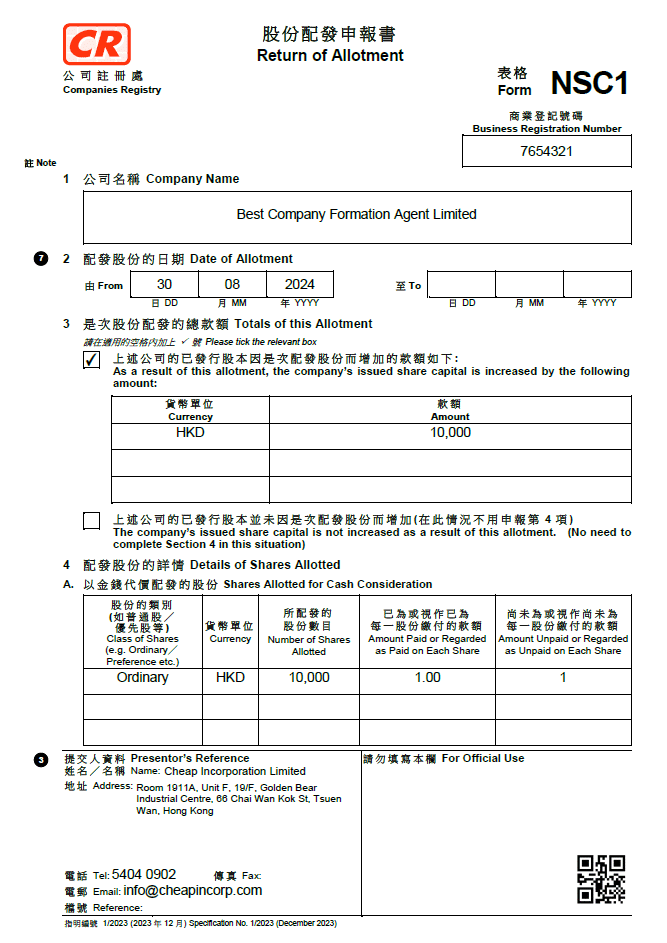

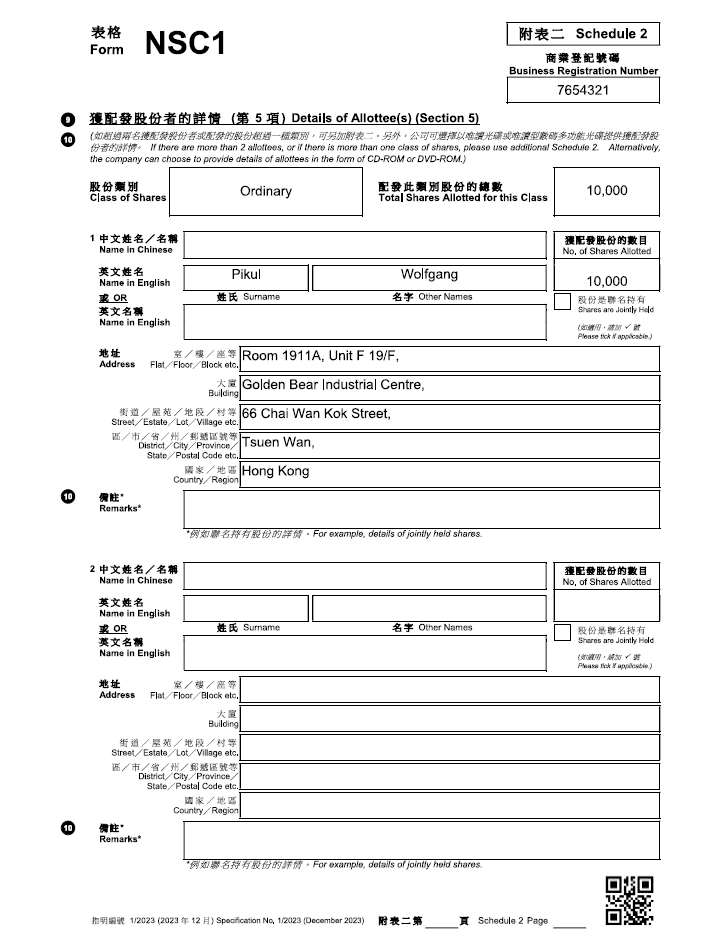

As your company secretary, we can assist in allotting additional shares to your company by submitting an NSC1 form on your behalf. Aside from that, we will also prepare a written resolution for you to sign. The resolution states exactly how many shares are allotted, who is allotted to, and the total company shares after completing the allotment to prevent disputes amongst shareholders in the future.

The screenshots below are an example of how an NSC1 form should be filled out and it is based on the assumption of the addition of a company member with 10,000 shares*

For page 1, please refer to the screenshot above.

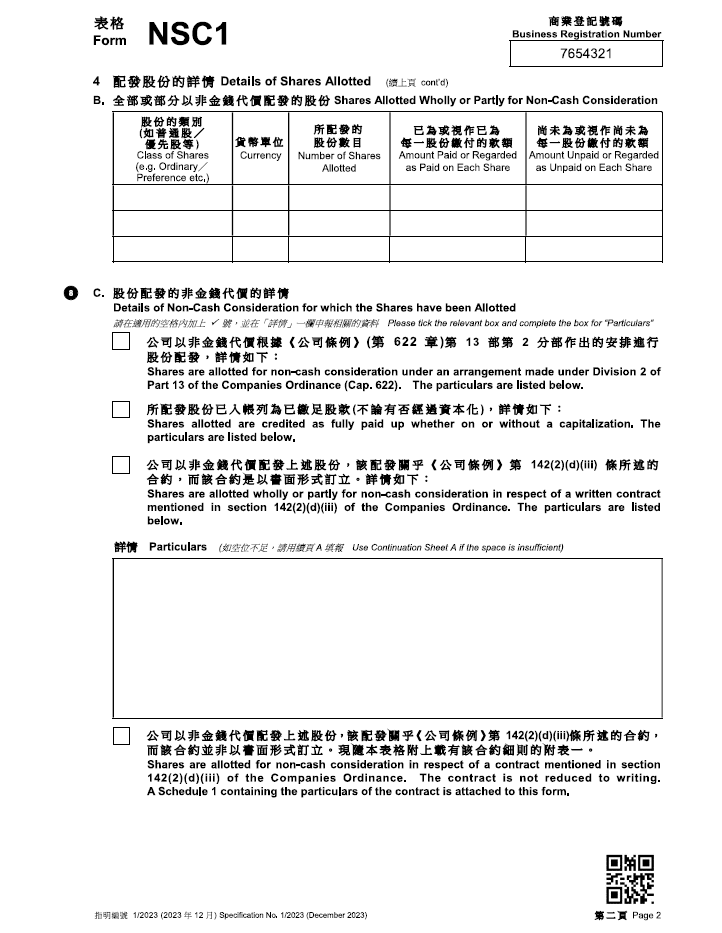

For page 2, leave it completely blank except for the business registration number section on the top right corner.

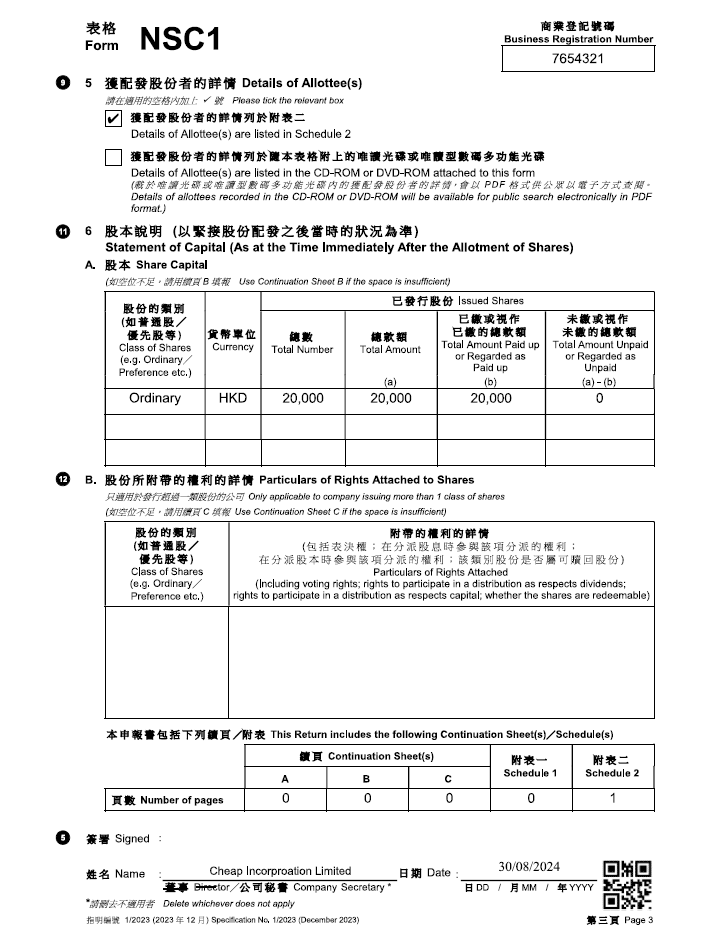

For page 3, please refer to the screenshot above.

For page 4, please refer to the screenshot above.

Share Transfer

As for a share transfer, the process can be complicated because it involves the tax department, also known as the Inland Revenue Department (IRD). For instance, you no longer want to be part of your company, so you decide to sell it to a third party. In this case, a share transfer is the only viable option as there is no need to allot additional shares. In another case, if you want to add an extra company member but don’t feel the need to add additional shares to the company, a share transfer is also suitable.

If your company has not commenced business operations since its incorporation date, then stamp duty is not required. Conversely, if your company has commenced business operations, you will need to submit an unaudited report, also known as a management account (general ledger, profit and loss report, balance sheet etc.) certified by you (the sole director) to the IRD for further review. The purpose of submitting your accounting records is that the IRD wants to make sure your company’s value is as accurate as you presented. This also has to do with stamp duty because the IRD will calculate the amount that needs to be paid based on how much you will sell your company per share.

Accounting Reports

Besides company formation, Cheap Incorporation Limited is also a well-established accounting firm in Hong Kong. If you need help with accounting, please feel free to send over your supporting documents such as bank statements, expense receipts, and invoices. As mentioned above, you may need to submit a management account if your company has commenced business operations.

If you have an accounting background, you may want to consider using a software called Xero where you can generate your company’s financial data at a lower cost. However, please beware that some company formation agencies may persuade you to buy the software from them for a marked-up price way above the market value. We encourage you to stay cautious and vigilant because you can simply purchase the software from Xero’s official website.

We hope you get to learn more about the two main ways of changing your company’s share structure and know the main differences between them. If you are interested in opening a company with us in Hong Kong or simply just want to switch over to us. Please feel free to contact us by email at info@cheapincorp.com or by WhatsApp at +852 5404 0902.